Q2 M&A Update: Deal Counts Down Again, Yet Capital Deployed Reaches Peak 2021 Levels

With Q2 behind us, we have pulled PitchBook data covering the last five years, encompassing 84,000 US-based transactions. Some trends were expected, others pleasantly surprising.

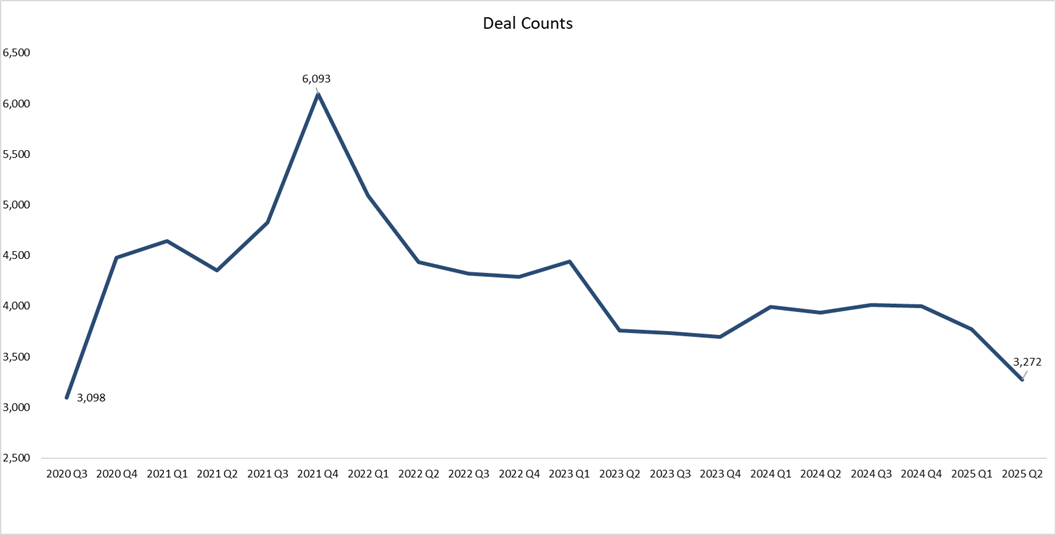

To be expected, Q2 2025 deal counts are down ~20% YoY and at their lowest levels since Q3 2020. This is consistent across all key industries, and quite drastic in those most exposed to tariff uncertainty, such as MFG/Industrial, down almost 40%.

Deal volume resurgence has yet again been delayed due to new macro headwinds

All key industries are trending similarly, yet some such as Software and Compliance + Cyber have generally been more resilient

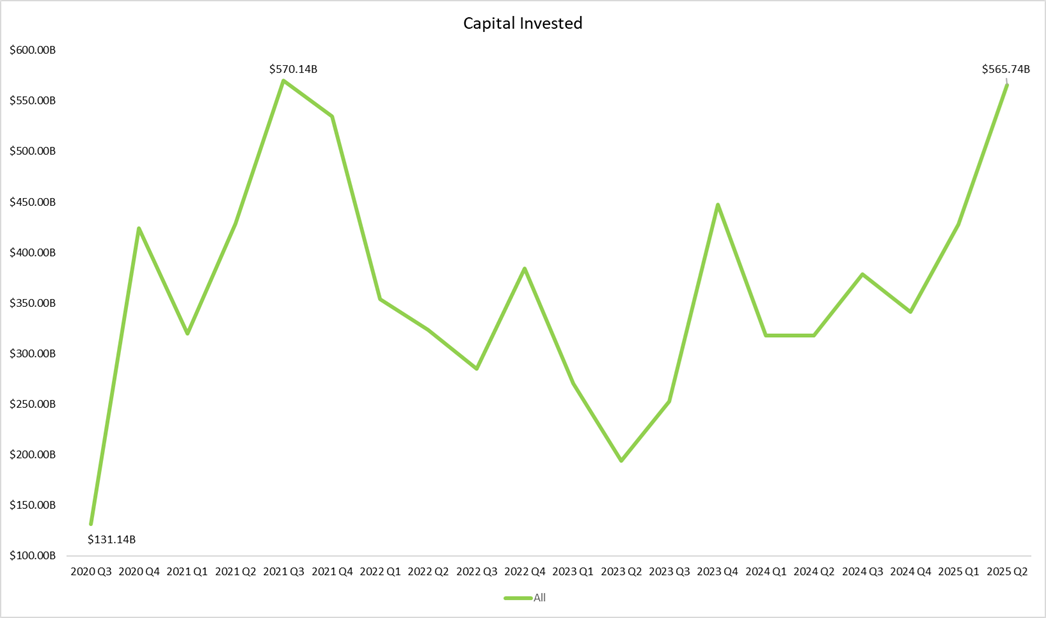

However, capital deployment has surged, reaching its highest level since Q3 2021 and the second-highest level in five years.

Capital Invested (capital deployed from US-based M&A transactions)

This has resulted in the highest average deal values over the last five years.

This suggests that while fewer deals are closing, they’re significantly larger, including more billion-dollar transactions and even mega transactions at $10 billion+ (three $30 billion deals in Q2 - see below).

• Capital One’s acquisition of Discover for $35b

• Charter’s acquisition of Cox for $34.5b

• xAI’s acquisition of X for $33b

Larger transactions also signal a continued flight to quality, which makes sense in an ongoing, uncertain macro climate. Furthermore, given the scarcity of larger companies and the increased demand from acquirers, this drives strong and even premium valuations for such high-quality, scaled assets, which we’ve seen firsthand.

Additionally, these levels of capital deployment and the flurry of mega transactions support the notion that M&A regulations have eased and are likely to continue under the Trump administration.

Lastly, these exits, combined with the recent surge of successful IPOs and the ongoing bull market, are crucial for replenishing the liquidity-starved LPs, which should, in turn, bolster new investment and acquisition activity from highly cautious and conservative funds and strategic acquirers.

While the deal volume remains problematic, capital is being deployed at record levels and is expected to continue as many M&A headwinds subside in the coming quarters.

Therefore, if you run a high-quality, scaled asset, the current window may be as attractive as any we’ve seen since 2021. Let’s discuss how you may realize a premium outcome while the flight-to-quality dynamic persists.