The Rise of AI Acquihires: A Win-Win for Start-Ups and Strategics

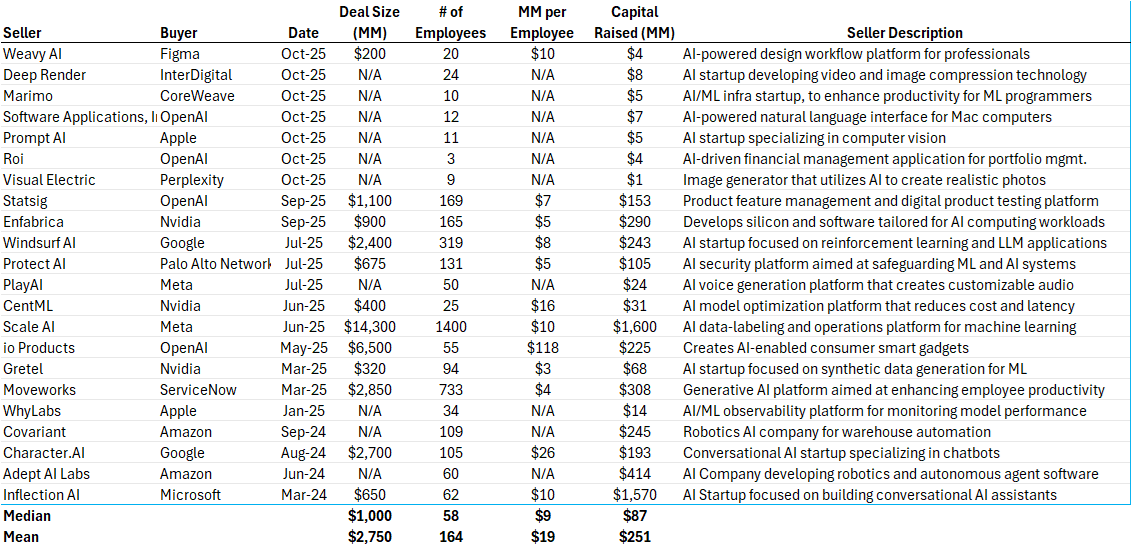

The pace of AI acquihires continues to accelerate, with 2025 already seeing a strong wave of transactions involving companies like Figma acquiring Weavy AI, InterDigital absorbing Deep Render, and CoreWeave snapping up Marimo. These deals are not just about tech—they’re about people, capabilities, and a strategic edge.

This growing trend reflects two converging forces: the relentless need for legacy companies to infuse AI into their offerings, and the desire among AI-first startups to join larger platforms that offer immediate scale, stability, and real monetization pathways. Not to mention a quick and massive windfall.

October Saw a Significant Ramp Up in AI Acquihires of Newly Formed Teams Who Raised Minimal Capital

Why Buyers Are Hungry

Large AI incumbents, technology titans, and late-mover SaaS platforms increasingly view acquihires as the fastest way to bridge their AI capability gap. Building advanced AI features from scratch takes time, highly scarce talent, and iteration—luxuries many public or growth-stage firms don’t have. With market expectations moving faster than roadmaps, these players are opting to acquire pre-built teams with domain expertise and functioning AI products.

Why Startups Are Selling

On the flip side, many AI startups are facing crowded markets, unclear monetization paths, and customer acquisition challenges. While the hype around AI remains strong, not all startups are gaining traction fast enough to stay independent. For many, a partial exit via acquihire offers cash, resources, and upside. With retention bonuses, equity rollovers, and growth incentives, founders can continue building—but now with distribution, support, and a real platform behind them.

AI Acquihire Premium

The financial incentives can’t be overstated. While headline deals like Meta’s acquihire of Scale AI grab attention, transactions are frequently closing at $5–10 million per employee—an unprecedented premium that almost certainly won’t persist. For AI founders, early teams, and investors, this moment offers a rare chance to cash out meaningfully without shouldering the full long-term risk. Just as importantly, many are retaining real upside potential, now backed by the resources, distribution, and stability of a larger, well-capitalized platform.

Win-Win When Structured Right

When these deals are thoughtfully structured, the outcome is symbiotic: the acquiring company gains hard-to-hire AI talent and real product innovation, while the startup gains resources to scale its impact. Notably, the acquihire model aligns incentives—founders typically stay on to lead internal product initiatives, maintaining continuity and cultural glue post-transaction.

The Outlook

This trend shows no signs of slowing. With AI reshaping every layer of enterprise software and infrastructure, non-AI-native strategic buyers are under growing pressure to move quickly. For the hundreds of well-funded AI startups with exceptional teams and promising products—but unclear paths to scale—this moment offers a rare opportunity to lock in a meaningful win, retain upside, and increase their odds of long-term success within a larger platform.